India Awaits. Your Australian Super Fund is Ready to Invest

Services

Invest Your Super Fund in the Indian Market

SMSF Overseas Investments

We specialize in assisting SMSFs diversify their portfolios to Indian Equity Stocks and MutualFunds. With India emerging as one of the world’s fastest growing and dynamic economies, investing in its equity market offers SMSF trustees unique opportunities for long-term growth and diversification. We provide expert guidance and access to tailored investment strategies that allow SMSF holders to capitalize on India’s booming industries such as technology, pharmaceuticals, infrastructure, consumer goods and so on.

Our team ensures that your overseas investments align with your retirement goals, while navigating the regulatory complexities and optimizing your SMSF’s performance for a secure financial future.

- ZSMSF

- ZFutureproof

- ZStrategize

- ZExpand

- ZGlobalize

Special Emphasis on Indian Investments

- Corporate trustee is mandatory to invest in India equity markets. If the trustee is individual, then NRI backed SMSF cannot invest in India.

- If Non-Resident Indians (NRIs) hold 51% or more in the Super Fund; then SMSF can invest in Indian Mutual Funds only.

- If Foreign Nationals (non-NRIs) hold 51% or more in the Super Fund; then SMSF can invest in

Equity Stocks and Mutual Funds in India.

- SMSFs cannot directly invest in India due to stricter regulations set by the Indian government.

- To explore investment opportunities in India, the trustee must appoint a broker and custodian who will open an investment account for SMSF.

- Broker and Custodian will open account following below steps:

- Apply for PAN card Apply for SEBI registration certificate

- Open for US$ and INR denominated bank account in India

- Open Custody account

- Open Stock Brokerage account and Mutual Fund Execution account

- The funds invested in India are repatriable to Australia anytime without any regulatory

permission or paper-signing.

- Super Fund

- ABN Registration

- Trust Deed

- 12 months Bank Statement

- Corporate Trustee

- Certificate of Registration

- Constitution Document

- ASIC Extract from Website

- 12 months Bank Statement

- KYC documents of Shareholders

- Passport

- OCI Card

- PAN

- Driver’s License

- The investments can be done in following assets:

- Equity Stocks

- Mutual Funds

- Equity Schemes

- Bonds / Debt Schemes

- Hybrid Schemes

- International Schemes

- Bonds, Debentures

- The investments will be done in Indian Rupees. The investments will be exposed to currency

risk. - Investment can be viewed and managed through our investment portal and mobile app.

Web-Portal Access

https://www.samarthcapital.in/login/Mobile App for Android Users

https://play.google.com/store/apps/details?id=com.samarthcapitals.samarthcapital&hl=en_INMobile App for iPhone Users

https://apps.apple.com/us/app/samarth-capital/id1542438962

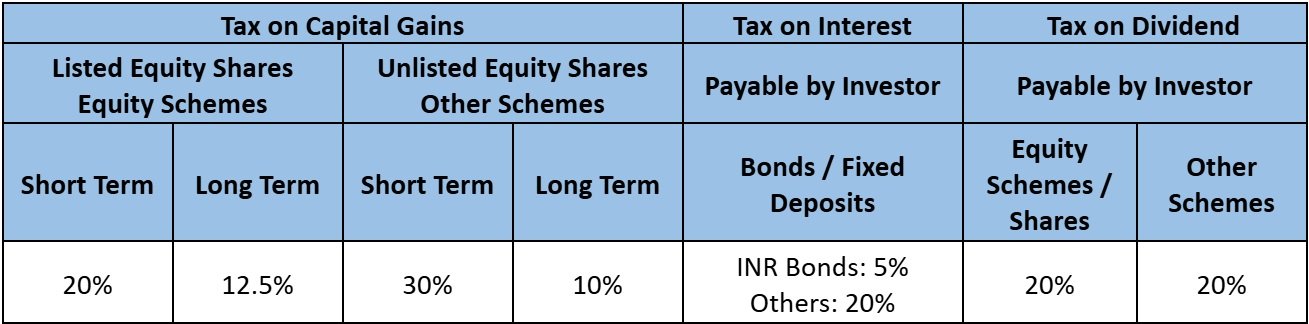

- Capital Gains, Interest, Dividend accrued on investments are taxable in India.

- The India tax rates:

- Double Tax Avoidance Agreement between Australia and India is applicable. Credit for taxes paid in India will be allowed to be off-set against global income taxed in Australia.

- In case the tax rate is higher in Australia, the excess tax needs to be paid in Australia.

- In case the tax rate is lower in Australia, then tax credit will be limited to the Australian tax rate.

- Link to access DTAA:

https://www.incometaxindia.gov.in/Pages/international-taxation/dtaa.aspx

- Tax returns needs to be filed in India as well for income earned in India.

Global Opportunities, Local Growth – Diversify Your Super Fund Today!

Have a Question?

The investment management can be self-managed or can be entrusted to us. Mutual funds can be viewed and managed through our investment portal.